Saturday, December 21, 2013

Thursday, December 12, 2013

Moving Tips Agents Should Give Their Clients

If you’re a real estate professional, you know how stressed clients who are moving can get, especially if they’re moving for the first time or haven’t moved in a long while. But as an industry professional, you can offer them more guidance than you think. They already trust you to sell their home or find them a new one – why not also help them weather the other parts of moving, too? Here are some ways you can assist your clients in the moving process.

- Give them advice for finding a reliable moving company. When clients don’t desire to do the packing and/or moving themselves, they’ll need to hire a moving company. However, many clients don’t know the first thing about comparing companies and choosing the best fit for them. Since you know their situation, give them some tips for finding a company that will offer a good deal. If you know of a reputable company, let your clients in on your secret. Furthermore, refer them to the Federal Motor Carrier Safety Administration’s brochures, Moving Fraud Prevention Checklist and Red Flags of Moving Fraud, on www.protectyourmove.gov.

- Create a moving checklist. Many clients are unsure of what type of timeline is required for their move. Make a checklist that breaks down tasks that should be performed each week, starting several months before moving day. This will help your clients stay organized – and they will love you for it!

- Help them understand the difference between basic released value liability and full value protection. Clients often believe that moving companies will pay them the full amount for their property if lost or damaged en route to their new home, however this is not always correct. As a seasoned professional, educate your client on the difference, and perhaps recommend they move certain items themselves, especially items moving companies don’t transport.

- Share budget suggestions. Since you are better equipped to estimate how much various parts of a move might cost, you can provide your clients with this information. If their budget is tight, assist them with whittling it down to the essentials. Also, refer them to the Internal Revenue Service site’s section on moving expenses so they can check for tax deductions they might be eligible for.

- Offer a list of recommended service people. It can be exhausting to spend hours and hours researching service people needed before and after a move. Provide your clients with a list of people you recommend, including a cleaner, exterminator, interior decorator, handyman, contractor, and anyone else you find necessary or helpful to clients during the moving process.

Provide extra value to your clients by going above and beyond the call of duty. Not only will your clients be grateful for the assistance, but they’ll probably be even more likely to refer your services to their friends, family, and coworkers. Click here for the article on Keeping Current Matters.

Tuesday, December 10, 2013

Keeping Current Matters: Harvard: 5 Financial Reasons to Buy a Home

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. This year he released a new paper on homeownership - The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home.

Here are the five reasons, each followed by an excerpt from the study:

1.) Housing is typically the one leveraged investment available.

“Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.”

2.) You're paying for housing whether you own or rent.

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.”

3.) Owning is usually a form of “forced savings”.

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

4.) There are substantial tax benefits to owning.

“Homeowners are able to deduct mortgage interest and property taxes from income...On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.”

5.) Owning is a hedge against inflation.

“Housing costs and rents have tended over most time periods to go up at or higher than the rate of inflation, making owning an attractive proposition.”

Bottom Line

We realize that homeownership makes sense for many Americans for many social and family reasons. It also makes sense financially.

Tuesday, November 26, 2013

Wednesday, November 20, 2013

From White Picket to Upcycled Pallet Fences: Millennials and Housing

by Jim Haney on November 20, 2013 in Millennials Click here for the article on Keeping Current Matters site.

Critiques and defenses about Millennials abound. However, I think an overlooked aspect of the kerfuffle over Generation Y is the question “Why?” Although it is great to spur thegeneration on to great heights, it is crucial we understand some of the hurdles they are facing, economically and socially in order to anticipate how the market will have to change and adjust to accommodate a new generation’s capabilities and values.

Critiques and defenses about Millennials abound. However, I think an overlooked aspect of the kerfuffle over Generation Y is the question “Why?” Although it is great to spur thegeneration on to great heights, it is crucial we understand some of the hurdles they are facing, economically and socially in order to anticipate how the market will have to change and adjust to accommodate a new generation’s capabilities and values.

Educational Debt & Credit

No big newsflash here: millennials are facing unprecedented levels of debt, between the various recessions, housing bubbles, and explosion of educational debt. New legislation in the works is attempting to help set up a more stable higher education financing system as well as relieve the staggering debt loads. Although debt forgiveness is the big buzzword these days, most students will still face shouldering a majority of their debt. Fortunately for the economic outlook, the legislation focuses on creating more income-based repayment plans that won’t put millennials on the street. However, the big question that remains is how will this affect their credit?

Public vs. Private Sector

With the specter of the 2008 housing bubble burst looming over everyone’s head, the situation is no longer about whether or not millennials are willing to take on more debt or have the income to cover minimum payments, it is about if lenders are willing to take on the risk. President Obama has rolled out plans that Fannie Mae and Freddie Mac will be gradually diminished, leaving the private sector to provide the backbone of risk management. With first-time buyers being edged out of the market due to new credit requirements, we could see a short-term slowdown in home-buying.

Uncertainty

Surprisingly, the instability recently exhibited by the U.S. government shutdown and continued clamor over the debt ceiling may actually work in the market’s advantage. Millennials, wary of being overly reliant on vacillating government promises, might become increasingly inclined to use their savvy to explore home equity loans andcarefully consider newly-revised reverse mortgages as part of their retirement plans. Having front-row seating for the recent economic meltdowns, the newest generation will be more inclined to do their research and not bite off more than they can chew, meaning they might, actually, leave a positive legacy for the housing industry.

American Dream

As the Keeping Current Matters crew mentioned, homeownership is still an important idea to many Americans. If the government and the private sector work together to slowly adjust the system and increase stability, which is already the direction we are driving in, we can expect to see homeownership continue to increase with this generation. However, we should expect to hold the memory of Desi and Lucy fondly in our hearts, and leave them there as the face of home buyers will be forever changed.

It is a pervasive misconception that millennials are thoroughly disenchanted with the concept of settling down. The revitalized home-making movement—as evidenced on social media platforms like Pinterest--within more progressive millennial circles would indicate that although it might take a bit longer for the birds to return from their explorations, they will inevitably nest.

Furthermore, the creativity and frugality of Generation Y will provide them fresh incentives to invest in housing as home ownership opens up new avenues hosting friends and international travelers. As this new group of home-buyers realizes that a mortgage doesn’t necessarily clip their wings, we should be able to anticipate a new, stronger, and invigorated market of responsible borrowers. These iPod-wearing, tweeting, bicycle-riding youngsters just might be the market we’ve been looking for.

Monday, November 18, 2013

Tuesday, November 12, 2013

Where Prices are Headed over the Next 5 Years

by The KCM Crew on November 12, 2013 in For Agents

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey

The latest survey was released last week.

Here are the results:

- Home values will appreciate by 4.3% in 2014.

- The average annual appreciation will be 4.2% over the next 5 years

- The cumulative appreciation will be 28% by 2018.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of over 16.8% by 2018.

Individual opinions make headlines. We believe the survey is a fairer depiction of future values. Click here for the article in Keeping Current Matters.

Thursday, November 7, 2013

In the Funk Zone

The first thing you notice in The Lark is an 18-foot-long, 2,000-pound table with seating for 24, fashioned from a 200-year-old fallen tree rescued from an Oregon forest. The communal dining platform is more than just the most coveted table in this popular new Funk Zone spot. As something at once reclaimed, repurposed, handcrafted, great-looking, and a place for people to gather, it embodies the foundational ethos behind the restaurant. “The table was a labor of love, like the restaurant,” says Managing Partner Sherry Villanueva. “Everything here is vintage, repurposed, handmade, original and special – and the communal concept is the core of what we’re about.” The other tables were made from the same fallen tree. The seats in a row of semi-private booths are antique church pews. The bar stools and the dining room chairs were all bought second-hand. A 100-year-old Catholic confessional from Provence “houses” a pair of tables for two. But these are antiques made modern by context, from the long steel bar to the exhibition kitchen to the steel girders that frame the expansive patio. Executive Chef Jason Paluska’s New American menu follows suit, reviving “old” dishes through thoughtful tweaks at the edges and a laser focus on quality, care, creativity, craftsmanship and the best local ingredients. Charcuterie is available, but so are up-to-date deviled eggs stuffed with pancetta, jalapeño, smoked paprika and chives. The new vegetable darling, formerly boring cauliflower, is caramelized and served au gratin with gruyère, preserved lemon, chili flakes and bacon breadcrumbs. A whole grilled branzino cozies up with kale and fennel slaw, barley-caper risotto, grapefruit and salsa verde. And the classic half-roasted chicken with brown butter polenta and spinach is the hit of the house. Speaking of, Executive Sous Chef Nick Flores bats 1.000 in the clean-up spot, his handcrafted, understated desserts perfectly converging past and present.

Tuesday, November 5, 2013

Monday, November 4, 2013

Wednesday, October 30, 2013

Tuesday, October 29, 2013

Monday, October 28, 2013

Road to the NZ Open begins

The road to the New Zealand Open in Queenstown begins tomorrow for players and spectators alike as they prepare to experience the biggest golf tournament staged in NZ for many years.

The tournament, a tier one event on the PGA Tour of Australasia, will be held from February 27 to March 2 at The Hills Golf Course and Millbrook Resort and is set to be a truly iconic sporting event.

It will include a unique pro-am format played concurrently with the professional tournament following the principles established for the 2013 NZPGA Championship with a total prize purse for the event of NZD$900,000.

Tickets go on sale from 9am tomorrow (Friday 18 October) through Ticketek (www.ticketek.co.nz).

Day passes will cost $19.99 for Thursday and Friday (includes entry into both The Hills and Millbrook) and $29.99 for Saturday and Sunday. A season pass (four day) will cost $54.99. Children under the age of 18 will have free admission.

Tournament organisers are expecting around 20,000 spectators to watch the event in Queenstown and golf fans are being urged to get in early to book their trip.

Those who get in quick will have the chance to win an epic early-bird prize that is a once in a lifetime golfing experience.

Everyone who purchases tickets before December 15 will go into the draw to play The Hills with leading Kiwi golfer and two-time New Zealand PGA Champion Michael Hendry and All Black great Justin Marshall in the weeks ahead of the tournament.

The New Zealand Open Championship will give aspiring golfers from all over New Zealand a chance to play in the championship.

The National Open will host first stage pre-qualifying events around the country on Tuesday January 28.

Royal Auckland, Paraparaumu Beach (Wellington), Shirley (Christchurch) - which are traditional Open venues - and Chisholm Park (Dunedin) will host one-round first stage pre-qualifying events.

A total of 25 spaces in the final qualifying tournaments will be up for grabs at the first stage qualifying venues.

The final stage of qualifying will be held at the Omaha Golf Club and Cromwell Golf Club on Monday February 24 and Tuesday February 25 respectively.

Ultimately a total of 10 spaces in the final New Zealand Open field will be played for at the final qualifying tournaments.

New Zealand Open Tournament Director Michael Glading said: "These qualifiers are once again making the New Zealand Open accessible for golfers all around the country to take part in our iconic golfing event. We are hugely grateful for the support of all six qualifying venues.

"Many of these courses have their own legacy of hosting memorable New Zealand Opens and we are pleased that affinity with the championship will continue in 2014.

"We have had huge interest from elite players in New Zealand and Australia asking how they can play the NZ Open and this is their chance to be part of the best week on the national golf calendar in Queenstown."

Greg Turner, a two-time winner of the New Zealand Open, believed that there was no better time or place for golf fans to book in a golfing road trip.

"I don’t think that there is much doubt that Queenstown is the mecca of golf in New Zealand," said the 50-year-old Otago professional.

Turner said that huge quality and quantity of courses that Queenstown has to offer - aside from Millbrook and The Hills there is Jack’s Point, Kelvin Heights, Arrowtown, Cromwell, Wanaka and Alexandra - sets the region aside.

"It is the ideal place for a golfing getaway with your mates and the timing of the New Zealand Open makes for a perfect week of watching some of Australasia’s best, soaking in the atmosphere and playing some great courses while here.

"With the fine dining and wine, adventure activities, sight-seeing and the beauty of Queenstown it is a complete destination. For golf fans there is no better time to be here than during the New Zealand Open."

Michael Hendry, Mark Brown and Josh Geary are among the leading Kiwis who have already confirmed they will be in Queenstown looking to end the 10-year drought of a home champion.

Tournament organisers are in the process of approaching professional and celebrity players to participate in the New Zealand Open with further announcements to be made in the coming months.

Celebrities to have previously played at The Hills include Sir Ian Botham, Hollywood actor Don Cheadle, World No.1 amateur Lydia Ko and a number of sporting icons from Australia and New Zealand. Click here for the story on voxy.co.nz.

Saturday, October 26, 2013

Thursday, October 24, 2013

This is a Fantastic Sale! Proceeds benefit the Montecito Library

The Friends of the Montecito Library is having a book sale November 1 & 2 from 10am to 3pm. They'll have an amazing assortment of used books, with the majority priced at $3 per hardback and $1 per paperback. There will also be some rare/vintage/collectible books that are priced higher, but at a great bargain. All proceeds benefit the Montecito Library. The sale is in the Community Hall next to the library at 1469 East Valley Rd. Please pass this on to any friends who might enjoy the sale.

P.S. It's not too late to donate your garden and cookbooks. Drop them off October 30 & 31 at the library.

Tuesday, October 22, 2013

Monday, October 21, 2013

Friday, October 18, 2013

Thursday, October 17, 2013

Wednesday, October 16, 2013

Tuesday, October 15, 2013

Friday, October 11, 2013

Dog Day's With Ralph

Leader of the Pack

Ralph Lauren's new campaign rolls out accessories for a cause.

"Dogs have always been a part of the Ralph Lauren culture," the designer says. They've made regular appearances in campaigns (and the brand's clothes), with ads starring golden retrievers lounging by fires and twin terriers sporting polo shirts. And since 1982, when a stray wandered onto Ralph and Ricky Lauren's RRL Ranch outside Telluride, Colorado, and pulled on the couple's heartstrings, canines have been more than company emblems, they've been among their closest companions (they currentlyhave a Yorkie, Bikini).

So it's fitting that Lauren is showing his love for the species with "The Dog Walk," a video that highlights the brand's accessories from a dog's-eye view. Products include not only the requisite shoes and Yorkie-friendly handbags but also proper carriers and chic leather leashes. The video shows Ralph Lauren–clad models promenading their pups through the streets of New York and Paris. (Apropos, the canine talent were all rescue and ASPCA dogs, and have been adopted since the shoot.) "The Dog Walk" debuts October 15 on Ralphlauren.com, and 10 percent of sales from some of the featured accessories will be donated to the ASPCA in celebration of the organization's Adopt-a-Shelter-Dog Month. In the U.S. alone, more than three million adoptable pooches enter shelters every year. "We would do anything to save a dog," Lauren says.

Pictured above: Behind the scenes at "The Dog Walk" shoot

To read the full story, subscribe to Harper's Bazaar.

By Christine Whitney

Read more: Ralph Lauren The Dog Walk Campaign - Ralph Lauren Handbag Campaign 2013 - Harper's BAZAAR

Thursday, October 10, 2013

Wednesday, October 9, 2013

Tuesday, October 8, 2013

Saturday, October 5, 2013

Friday, October 4, 2013

Village Properties proudly participated in the American Heart Association’s 22nd annual Santa Barbara Heart Walk.

Village Properties proudly participated in the American Heart Association’s 22nd annual Santa Barbara Heart Walk. The Heart Walk took place on Saturday, September 21, 2013 at Fess Parker’s Doubletree Resort and raised over $195,000 for their fight against heart disease and stroke.

Village Properties has participated in the Santa Barbara Heart Walk for 10 years and has raised a total of $27,101. This year, the team enjoyed incredible weather and a great turnout with friends and co-workers, while raising over $2,000 for the American Heart Association.

Renee Grubb was a top fundraising participant, having raised close to $2,500 in the 3rd Annual Leadership Challenge that benefits the Santa Barbara Heart & Stroke Walk. According to Lisa Thomas, the AHA Business Development Director, “Renee’s leadership and personal fundraising efforts make a significant impact in the fight against heart disease and stroke!”

This year’s Village Properties team members included Lara Castagnola, Renee Grubb, Chris Burns, Sydney Burns, Kelsey Burns, Luke Burns, Cecilia Hunt, Shandra Campbell, Jim & Lucy Witmer, Christina Chackel, Haley Thomas, Margie Yznaga, Phyllis & John Lenker, Wayne Natale and Lynn Golden! - THANK YOU!!

Click here to view the amazing photos!

Thursday, October 3, 2013

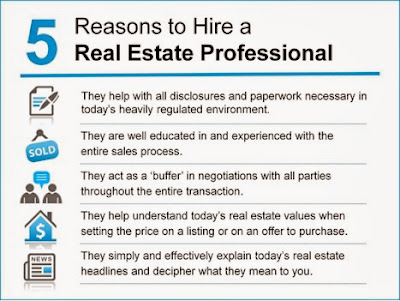

5 Reasons to Hire a Real Estate Professional

Today we are excited to have Ashley Garner, a Director of the North Carolina Association of Realtors (NCAR), as our guest blogger. Ashley was so inspired from our most recent edition of KCM that he chose to expand on one of his (and our) favorite slides from the presentation. - The KCM Crew

The real estate market is a place where most people will make their largest investment ever. It is a place where fortunes can be, and often are, made. It is not a place, however, for you to “wing it”.

While the myriad TV shows about real estate make the process look so simple – it’s not really that simple… they make it seem like all you need to do is slap a for sale by owner sign in the yard, have one open house with fresh flowers and fresh baked cookies and bam! SOLD! in one day. Well I can tell you that in New Hanover County, North Carolina it takes an average of 121 days to sell a home. An average means that some houses take much longer to sell and some much less than 121 days to sell.

You need a professional, full time, well educated, ethical and trustworthy REALTOR to represent you whether buying or selling real estate.

1 - Paperwork

Currently in North Carolina there are over 24 pages of contracts involved with buying or selling most homes. The state law requires much of this paperwork regardless or whether or not you hire a REALTOR. REALTORS are trained and educated on the contracts, which are constantly changing, so they can advise you during the process. They can also refer you to a real estate attorney to represent you on all legal matters involved in the process.

2 - Process

There are about 180 typical actions, research steps, procedures, processes and review stages in a successful residential real estate transaction that are normally provided by full service real estate brokerages in return for their sales commission. (Based on a report prepared by the Orlando Regional REALTORS Association). So this means that if you choose to go it on your own, you are going to have to do all 180 things yourself… or they don’t get done… which probably means your transaction doesn’t end in a successful purchase/sale.

3 - Negotiation

While there will always be that one guy (or gal) who thinks he (she) is the all-time greatest negotiator, the vast majority of folks do not like confrontational interactions. A negotiation for the purchase/sale of an asset as large as a piece of real estate can be a very confrontational interaction. The role of the REALTOR is to act as a buffer between the two parties who are in the midst of a very emotional and high-level financial transaction, both wanting to get the best they can get often at the detriment of the other party. A real estate professional is experienced in all aspects of the negotiation and is bound legally to do only what is in the best interest of his/her client.

4 - Values

Perhaps the single most important aspect of the transaction is the value of the piece of property.

If you are a seller you want to know how much you can expect to get for the sales price and how much of that you will walk away with in your pocket. You want to advertise the property for sale at the right price so you sell for as much as possible but you don’t want to price it so high that no buyers make you an offer (and YES if you price it too high MOST buyers will not want to offend you by making a low offer…thus you don’t get any offers).

If you are the buyer, you want to know how much to offer. Now multiple offer situations are happening more frequently and if a buyer offers too low, they can either be rejected completely by the seller or they can cause the negotiation to take too long thus allowing time for a competing bid to come in… allowing the seller to be in the driver’s seat.

5 - Teacher

Any good professional, whether a real estate professional, doctor, lawyer, CPA, etc., will have the heart of a teacher. Real estate brokerage is a service business. The professional REALTOR is there to educate you about the conditions impacting today’s real estate market. It is as easy as picking up the newspaper or searching the Internet for real estate news to see conflicting headline after conflicting headline. “Prices are up 20%”, “Among worst markets in nation”, “Best year since the crash”…well which is it? All real estate is local and your real estate professional will know the local market conditions and will lead you through the process, like any good teacher would, making sure you understand all that is going on around you.

A real estate professional is a crucial member of your team when buying or selling real estate. You could be buying your first home or your tenth home, an investment property or a vacation home, commercial or residential…whichever it is you are best served in the care of a full time, well educated, ethical, trustworthy real estate professional.

Tuesday, October 1, 2013

The game of golf - 'In Play' extended content, interviews with Jimmy Roberts

This week's episode of "In Play with Jimmy Roberts" touched upon several unique subjects tied to the game of golf. Here's a look at some of the topics featured in the show, as well as some extended interviews and additional content. Click here to watch!

Thursday, September 26, 2013

Event! Foley Food and Wine Society Culinary Arts Launch

This is at The Bacara this Saturday. See you there!

Santa Barbara Culinary Arts Presents... The FFWS Launch Party

Date: Sat, Sep 28, 2013

Time 3:00 PM to 6:00 PM

Venue: Bacara Resort & Spa - Santa Barbara, CA

Contact: Danielle Maxwell Phone: 855-883-8688

Email: concierge@foleyfoodandwinesociety.com

This remarkable event will include: Select tastings from the portfolio of world-class wines including Chalk Hill, EOS, Firestone, Foley Estates, Foley Johnson, Kuleto, Lincourt, Sebastiani, and Three Rivers Cuisine and pairings presented by Miró Restaurant's Chef de Cuisine Johan Denizot and the Bistro's Chef de Cuisine, Chris Turano, who was featured on the Food Network's popular program Chef Wanted A new generation of culinary talent from the School of Culinary Arts at SBCC and from the Santa Barbara Culinary Arts group, as they create exclusive foods to pair with the wines Unique music presented by Justin Claveria's Jazz Quartet. An unforgettable, 4-star location—the Bacara Resort & Spa—in the Foley portfolio of Properties ...and much, much, more. Click here for more information and to purchase tickets.

Santa Barbara Culinary Arts Presents... The FFWS Launch Party

Date: Sat, Sep 28, 2013

Time 3:00 PM to 6:00 PM

Venue: Bacara Resort & Spa - Santa Barbara, CA

Contact: Danielle Maxwell Phone: 855-883-8688

Email: concierge@foleyfoodandwinesociety.com

This remarkable event will include: Select tastings from the portfolio of world-class wines including Chalk Hill, EOS, Firestone, Foley Estates, Foley Johnson, Kuleto, Lincourt, Sebastiani, and Three Rivers Cuisine and pairings presented by Miró Restaurant's Chef de Cuisine Johan Denizot and the Bistro's Chef de Cuisine, Chris Turano, who was featured on the Food Network's popular program Chef Wanted A new generation of culinary talent from the School of Culinary Arts at SBCC and from the Santa Barbara Culinary Arts group, as they create exclusive foods to pair with the wines Unique music presented by Justin Claveria's Jazz Quartet. An unforgettable, 4-star location—the Bacara Resort & Spa—in the Foley portfolio of Properties ...and much, much, more. Click here for more information and to purchase tickets.

Thursday, August 15, 2013

Welcome To Montecito Lifestyle Blog

Like golf?

View score cards and get more information on our many, spectacular golf courses.

Local Events

There is always something FUN going on around town...visit our Events Calendar to learn more about culture and attractions in Santa Barbara.

View score cards and get more information on our many, spectacular golf courses.

Local Events

There is always something FUN going on around town...visit our Events Calendar to learn more about culture and attractions in Santa Barbara.

Subscribe to:

Posts (Atom)